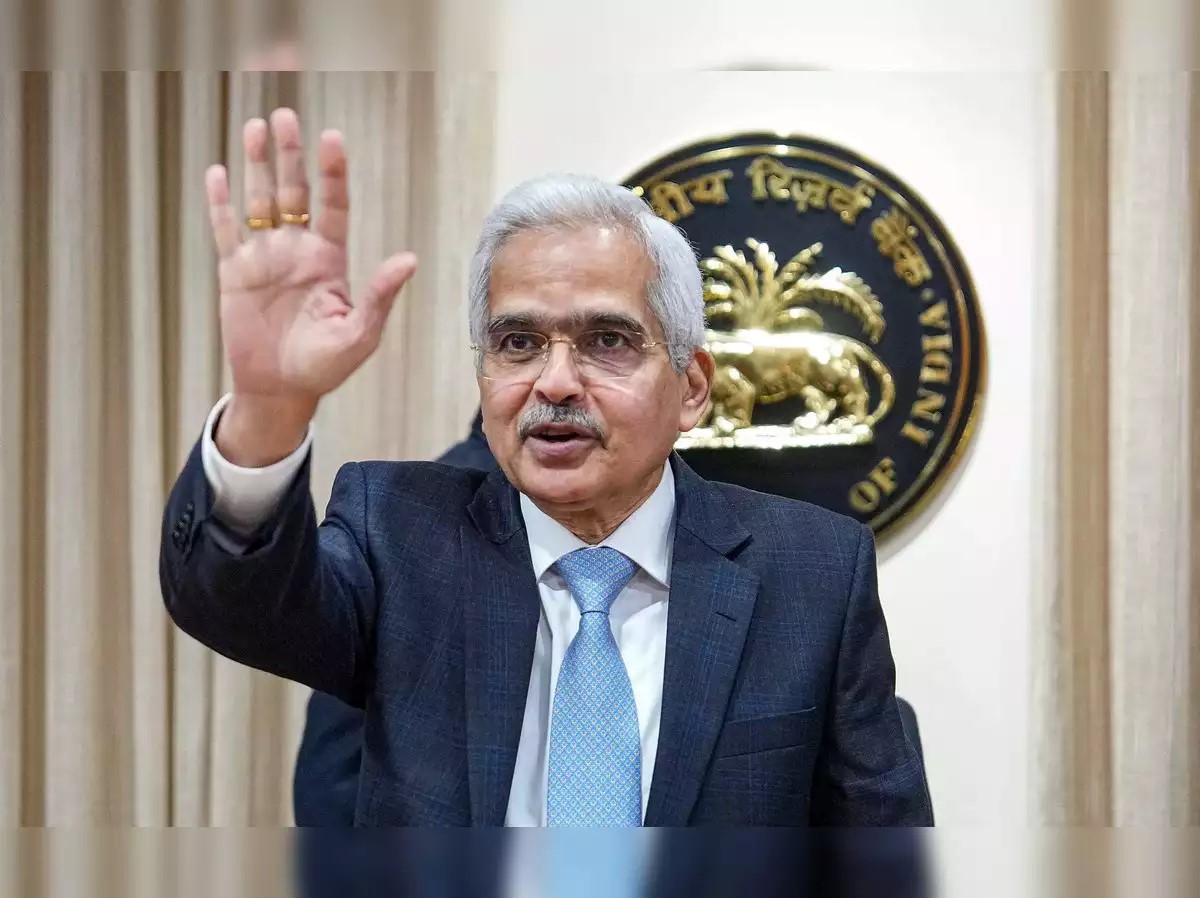

The Reserve Bank of India (RBI) Governor Shaktikanta Das has raised concerns about the potential disruptions technology could bring to the financial system. At a recent financial summit, Governor Das highlighted both the benefits and risks associated with rapid technological advancements in the sector. Governor Das acknowledged the transformative power of technology in enhancing financial inclusion, improving efficiency, and offering innovative products and services. However, he emphasized that these benefits come with significant risks that must be managed prudently.

“Technology is a double-edged sword. While it offers immense potential to revolutionize the financial landscape, it also poses challenges that could disrupt the stability and security of the financial system,” Das remarked. Governor Das advocated for a balanced approach to technological adoption in the financial sector. He called for collaboration between regulators, financial institutions, and technology providers to create a secure, efficient, and inclusive financial ecosystem.

The key lies in striking the right balance between innovation and regulation. We must harness the power of technology while ensuring that it does not compromise the stability and integrity of our financial system, he concluded. As the financial sector continues to evolve, Governor Das’s cautionary message serves as a reminder of the critical need to manage technological disruptions carefully. The RBI remains committed to fostering innovation while safeguarding the interests of all stakeholders in the financial system.